Over millennials, gold has been proven to be the best store of value, medium over exchange and international unit of account. Since 1971, the fiat banking system had exacerbated the instability of the financial system. We believe that gold and silver are a superior form of money. For those who believe the same AgAu wants to provide with a true alternative to fiat currencies.

The principle of voluntaryism is core to the free trade of ideals, goods and services. AgAu offers a direct way to do so eliminating financial intermediaries. AgAu tokens allow for permission-less, decentralised, peer-to-peer transactions.

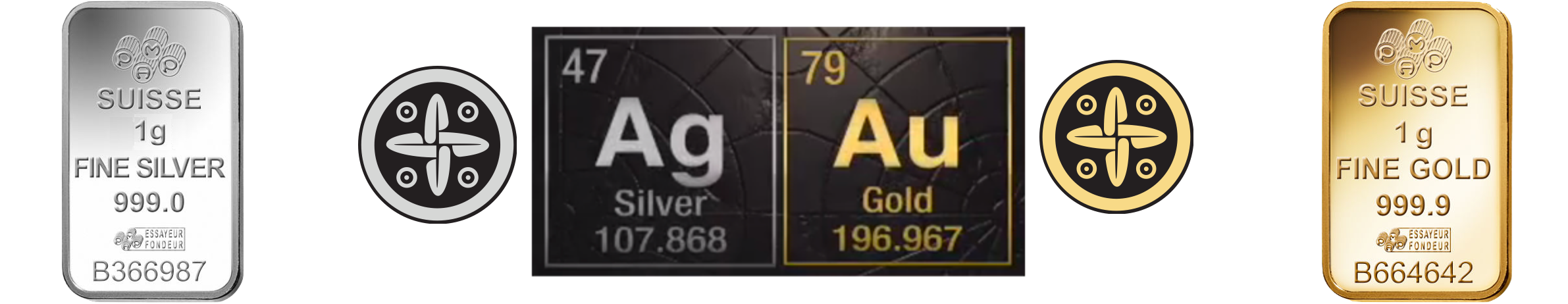

AgAu believes in the fundamental human right of property. We believe that every human has an alienable right to own their thoughts, their own bodies and other private property. This is why we offer Direct Ownership. Each token represents the direct property of 1 gram of precious metal. 1 gram of gold for AGLD (₳u) and 1gram of Silver for ASLV (₳g). At any time, AgAu token holders can choose to redeem their tokens for the corresponding precious metal in Switzerland.

Every relationship is based on two pillars: Trust and Respect. ₳g₳u ensures transparency and ownership using Distributed Ledger Technology and Smart Contract technologies. With (DLT) more trust is achieved through a decentralised system where the data is immutable and verified by multiple parties. With Smart contracts, rules are respected as they are written in the form of immutable code (“The code is law”).

“In the spirit of the initial Blockchain community, we created AgAu the Peer-to-Peer, Electronic Money System backed by Silver (Ag) and Gold (Au) in Switzerland”

“AgAu differentiate between fiat currency and money. The concept of Precious metals as money is anti-fragile, the more we depart from it, the more reasons we have to go back to it.”

AgAu offers a stable currency for cross border payments as well as transparent international pricing in a barter trade ecosystem allowing the free exchange of values by establishing a superior form of money enabling everyone to preserve and enjoy the fruits of their labour.

Express Your InterestWe are partnering with financial institutions, regulated vaults and storage facilities for custody, exchanges to create liquidity, and offer a lucrative partnership to gold owners and refineries as strategic partners. AgAu has a top-down approach (B2B) aiming to strategically position itself as an institutional-grade product before expanding quickly with our retail distribution partners (B2C).

Express Your InterestAgAu wants to reward the community that shares its values. If you are interested in being part of a vibrant and open community that encourages freedom, and moves us towards a better system, express your interest and be the first to own AgAu Tokens.

Express Your InterestAgAu is determined to create an ecosystem where hard-working people can execute transactions instantly in a transparent and permission-less system. AgAu ensures direct ownership of gold and silver by ensuring the transparency, efficiency, and effectiveness while contributing to the Sustainable Development Goals.

By using Distributed Ledger Technology and Smart Contracts, AgAu eliminates central points of failure and creates a stable, secure, and reliable form of money backed by silver and gold in Switzerland.

AgAu’s vision is to create a world with an open and reliable electronic peer-to-peer sound money system based on gold and silver. Read More Here

Swiss Silver and Gold Electronic Money System secures investment from high profile bankers and commodity trading experts.

Mark Valek joins AgAu.io Board of Advisors.

"In the event of a monetary reset, the consensus across the world would most likely be set on gold. "AgAu operates outside the legacy financial system and provides with a solution to depart from the fiat system and go back to sound money. Read More Here